Table of Content

In today's fast-paced business environment, the role of finance teams is shifting rapidly. As the future of AP automation takes shape, speed, accuracy, and visibility are no longer optional. Traditional accounts payable (AP) systems are falling behind. Manual handling of invoices and financial documents is not only inefficient but prone to error.

For companies leveraging Microsoft Dynamics 365, automating the accounts payable (AP) process has become a strategic necessity.

This guide explores how In an era where efficiency and accuracy are paramount in financial operations, Accounts Payable (AP) Automation emerges as a transformative solution. The benefits of AP automation extend beyond mere operational efficiency; they encapsulate strategic advantages that can redefine the financial landscape of businesses.

Managing the accounts payable (AP) process can be one of the most time-consuming tasks for any business. Manual invoice processing, approvals, and payments not only consume resources but also leave room for errors and inefficiencies. That’s why more and more businesses are turning to AP automation to streamline this function. By automating AP, companies can speed up payments, reduce costs, and improve visibility into their financial data. Let’s explore why automating your AP process could be one of the most important decisions you make for your company.

What is AP Automation?

At its core, AP automation is the use of technology to digitize, streamline, and automate the tasks involved in the accounts payable process from invoice receipt to payment. This includes capturing invoice data, matching invoices to purchase orders, routing approvals, and scheduling payments.

Traditionally, AP teams have relied on manual processes, paper invoices, spreadsheets, and email threads which are time-consuming, error-prone, and costly. AP automation eliminates these inefficiencies by replacing manual touchpoints with digital workflows and intelligent data processing.

Stat Block : The Business Impact of AP Automation in Dynamics 365 According to Forrester Total Economic Impact Study on Microsoft

Dynamics 365 Finance : Organizations using AP automation integrated with Dynamics 365 see up to a 70% reduction in invoice processing time and a 65% lower cost per invoice.

Understanding Accounts Payable Challenges : Accounts payable is a core function of every business, but traditional AP processes face several common challenges:

- Manual data entry leading to human error

- Lost or misplaced invoices

- Delayed payments affecting vendor relationships

- Lack of real-time visibility into liabilities

- High operational costs due to paper-based processes

Organizations that continue to rely on manual systems often experience bottlenecks, compliance risks, and operational inefficiencies.

Core steps of the AP process in Dynamics 365

- Vendor Setup and Management

- Purchase Order (PO) Creation and Matching

- Invoice Capture and Entry

- Invoice Approval Workflow

- Payment Processing

- Accounting and Ledger Integration

- Reporting and Audit

Core Functionalities in Dynamics 365 Accounts Payable

- Invoice Management

- Vendor Management

- Payment Processing

- Approval Workflows

Why Is AP Automation Critical for Scalable Finance?

Reduce Manual Work and Errors Manual data entry is prone to errors and can slow down the AP process.

From misplaced invoices to incorrect payments, these mistakes can cost businesses both time and money. AP automation eliminates manual data entry by capturing invoice information automatically, ensuring accurate and consistent data flow from start to finish.

Increase Efficiency and Speed

With AP automation, invoice approvals, and payments can be processed in a fraction of the time. Instead of routing physical paper invoices between departments, you can create automated workflows that route digital invoices to the right people for approval. This not only speeds up the entire process but also ensures compliance with your organization’s approval policies.

Financial Control

By automating the accounts payable function, companies can drastically reduce the labour-intensive and costly manual tasks associated with traditional AP processes. This automation translates into direct labour cost savings, as fewer resources are required to manage invoice processing, payments, and reconciliation.

Improved Visibility and Control

One of the biggest challenges with manual AP processes is the lack of visibility into where invoices stand in the approval process. Automated solutions provide real-time tracking, so you know exactly where each invoice is and when it will be paid. This level of transparency improves control over cash flow and strengthens vendor relationships by ensuring timely payments.

Real ROI: Cost Savings

Manual processes require significant resources to manage, from printing paper invoices to physically routing them between departments. AP automation can cut down on these overhead costs by digitizing and streamlining the entire workflow. Additionally, by processing payments faster, companies can take advantage of early payment discounts offered by vendors.

Enhanced Compliance

Automating AP processes can also help with compliance and audit readiness. The digitization of invoices and approvals creates an audit trail that is easy to track and retrieve. This helps ensure that all processes are consistent, reducing the risk of fraud or non-compliance with regulatory requirements.

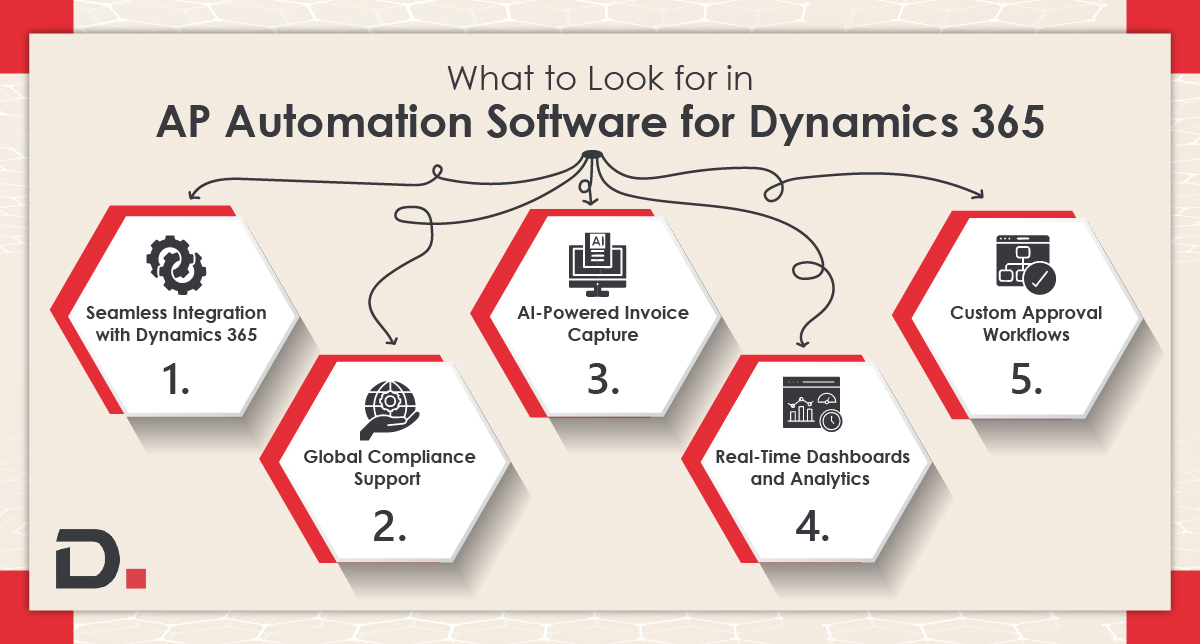

What to Look for in AP Automation Software for Dynamics 365

When selecting an AP automation solution for Dynamics 365, ensure it meets these criteria:

Seamless Integration with Dynamics 365: Look for solutions with native connectors or certified integrations with Dynamics 365 Finance and Operations. This ensures real-time data sync and minimal IT overhead.

AI-Powered Invoice Capture: Choose tools that support OCR, machine learning, and intelligent data capture for accurate invoice processing.

Custom Approval Workflows: The ability to configure workflows based on cost centers, departments, invoice amount, or vendor types is key to efficient approvals.

Real-Time Dashboards and Analytics: Visibility into KPIs like cycle time, exception rates, and spend trends helps drive better decisions.

Global Compliance Support: If you operate across regions, ensure your solution supports multi-currency, tax compliance, and regional regulations.

ROI Components :

Time & Labor Savings

Error & Leakage Reduction

Early Payment Discounts & Late Fee Avoidance

Other Benefits: Paper costs, scalability, compliance improvements, vendor relationship etc.

Real-World Example

Imagine a medium-sized manufacturing company. Let’s say: The accounts payable team deals with manual data entry, paper invoices, and slow approval cycles. Processing invoices takes several days, which delays payments and causes missed early payment discounts.

By implementing Continia Document Capture integrated with Dynamics 365 Business Central, the organization automates the entire AP process.

Invoices arriving by email or paper automatically get scanned, and data is extracted using OCR technology. The system matches invoices to purchase orders, routes them through predefined approval workflows, and posts them into Dynamics 365, all without manual effort.

This automation reduces AP processing time freeing the team to focus on exceptions rather than routine tasks.

Best Practices for AP Automation in Dynamics 365

To get the most out of your AP automation journey, follow these proven strategies:

| Best Practice | Why It Matters |

| Align automation goals with business objectives | Ensures relevance and strategic impact |

| Standardize invoice formats | Reduces errors and improves consistency |

| Customize approval workflows | Prevents bottlenecks and enhances control |

| Leverage AI for coding and matching | Boosts accuracy and speed2 |

| Enable mobile approvals | Keeps workflows agile and responsive |

| Conduct regular audits | Promotes continuous improvement |

| Monitor compliance | Reduces risk and simplifies audits |

The Future of Accounts Payable

The explosive growth of AI in AP signals a clear shift: businesses are embracing technology to provide best-in-class AP automation services to streamline and optimize their financial processes. This enables them to stay ahead of the curve and unlock new levels of performance.

How Forward-Looking Finance Teams Can Prepare Today

To stay competitive, finance leaders need to prepare now not wait until automation becomes the norm.

Invest in Scalable Solutions : Choose tools that support growth and adapt as your processes evolve.

Build Internal Buy-In : Engage stakeholders early and show how automation enhances accuracy, visibility, and control, not just speed.

Focus on Visibility and Collaboration : Forward-thinking teams don’t just automate tasks, they use data for smarter decisions.

Conclusion: The Future of Finance Is Automated

As businesses scale, the pressure on finance teams intensifies. Manual AP processes simply can’t keep up. With AP automation in Dynamics 365, you’re not just digitizing invoices, you’re building a smarter, faster, and more resilient finance function.

Whether you're a mid-sized company or a global enterprise, the time to automate is now. Embrace the future with Dynamics 365 and unlock the full potential of your AP operations.

Ready to transform your AP process? Explore AP automation solutions and unlock new levels of efficiency, visibility, and ROI for your finance team.

Contact Dynamics Square today and start your journey toward smarter, more efficient business management.

Don't let your business miss out on the benefits of a tailored Microsoft Dynamics 365 solution.

Disclaimer– “All data and information provided on this blog is for informational purposes only. Dynamics Square / MPG Business Information Systems Pvt. Ltd. makes no representations as to accuracy, completeness, currentness, suitability, or validity of any information on this site and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use.”

Related Posts & Blogs

Contemporary businesses are changing at a rate of knots using innovative business solutions to stay afloat. Know more about industry trends, challenges and opportunities in detail after going through an array of exciting blogs.

Read the blogs penned by industry-experts who know the nerve of the business to start your digital transformation journey.

AP Automation in Dynamics 365-Manual AP processes are slow, error-prone, and costly. Automating AP with Micros...

Unlock efficiency with accounts payable automation in Business Central. Explore key benefits for streamlined w...