Table of Content

Finance teams are well aware of the drawbacks of a manual accounts payable process. Dealing with stacks of paper invoices, reaching out to approvers individually, and mailing physical checks is not only slow and error-prone but also increases the risk of fraud and makes the audit more challenging. SMBs in Australia have switched to accounts payable automation lately but still 60-70% are still using managing accounts payable manually.

As per the research, accounts payable automation minimises human errors and can drive 70-80% time-savings for SMBs. If a company processes 10 or 20 invoices in a month, then there may not be any issues with manual accounts payable. However, if your monthly invoice processing is more than 50, shifting to accounts payable automation as soon as possible is a very smart decision.

So, how are you managing your payables- Manually or automated?

If you are managing accounts payable manually then stay

The list of challenges associated with the Manual Accounts Payable Process

Let’s go through the list of challenges that might adversely affect your business payable process:

Manual Data Entry

In a standard accounts payable process, you enter vendor invoice details, seek approval, and then make the payment. If manual data entry is used at each stage, errors are more likely, resulting in incorrect calculations, payments, and negative effects on your business finances. Identifying and fixing these errors requires manual review of spreadsheets, consuming valuable time that could be better utilised.

Difficult to Manage & Tracking Invoices

When you handle invoices manually, it’s quite hard to know if they are approved, waiting in someone’s drawer, or already paid. This lack of transparency can lead to communication problems within the company and with vendors as well. It can also mean that invoices get lost or misplaced. Without access to a good system ensuring efficient tracking can make month-end or year-end reconciliations a very cumbersome and time-consuming process.

Payment Errors

Has your finance team ever found themselves in a duplicate payment scenario? Sometimes suppliers send a second invoice if the first isn’t paid promptly, causing you to unintentionally pay for both. But this majorly happens when your business is operating in multiple locations, it can be quite confusing to know which location pays which vendor. This way, duplicate payments can harm your cash flow. If you can’t identify and get a refund for the duplicate payment, you may lose the money permanently.

Missing Purchase Order

Creating purchase orders is crucial as it helps prevent duplicate orders and unauthorized purchases. Purchase orders also enable you to monitor the items you have ordered and the agreed-upon purchase amount. Some business owners avoid using purchase orders, eliminating the difficulty and time-consuming nature of manual creation.

Delayed & Ineffective Processing

Handling your accounts payable manually can consume a significant amount of time, and if your internal procedures lack efficiency, the outcome may fall short. In a medium-sized company, multiple staff members may be required to approve a vendor invoice before processing payment. If the invoice has to be circulated physically or via email for approval, it can result in a delay. Consequently, you might miss out on an early-bird discount or incur late payment penalties by the time the invoice is settled.

Solution: Accounts Payable Automation!

To overcome the above challenges, SMBs need to embrace accounts payable automation. Let’s look deeper into this solution.

What is Accounts Payable Automation?

AP automation technology revolutionizes routine tasks, including the receipt of invoices, coding, approval routing, payment processing, and reconciliation. This process eliminates the manual data input at every stage, empowering your team to authorize payments through a simple mouse click.

How Does Accounts Payable Automation Work?

AP automation software transforms your supplier invoices into a digital format and guides them through a digital workflow until payment. Under this process, OCR or optical character recognition is used to extract information from invoices. Some systems utilise machine learning to enhance accuracy over time. You can easily customise all the rules as per your business i.e. approval hierarchies. This way, a business can eliminate the necessity for manual intervention for the majority of invoices.

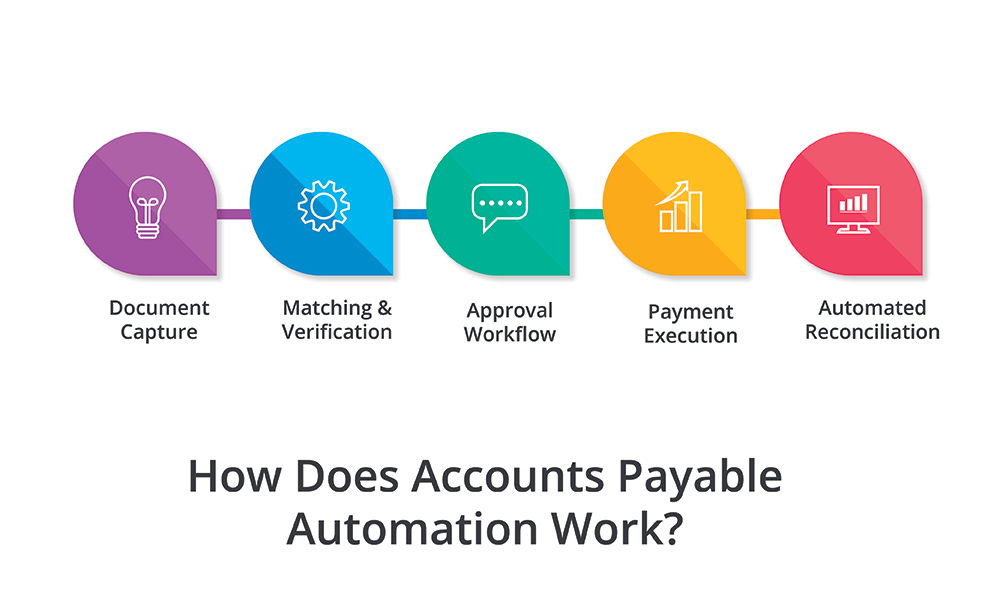

Here is its process:

Step:1 Document Capture

The first step in AP automation involves digitizing incoming invoices. Optical Character Recognition (OCR) technology scans and converts paper invoices into digital data. Simultaneously, e-invoicing systems allow vendors to electronically submit invoices, eliminating the need for physical paper transactions.

Step: 2 Matching & Verification

Once your invoice data is captured, the system automatically checks and aligns invoices with corresponding purchase orders and delivery receipts. This guarantees a perfect match between invoiced items and agreed-upon purchase terms. Automating this step helps businesses spot discrepancies, ensuring that only accurate invoices proceed to the next stage.

Stage: 3 Approval Workflow

The AP automation system adheres to organisation-defined rules, directing invoices to the appropriate personnel or department for approval. This routing is determined by factors like invoice amounts or vendors. The system enables you to set configurable alerts and reminders to expedite the approval process, ensuring timely reviews, preventing oversights, and maintaining a transparent audit trail for all approval actions.

Step:4 Payment Execution

After invoice approval, the AP automation system simplifies the payment process. This includes scheduling payments strategically for cash flow optimization, selecting the preferred payment method, and automating payments with minimal human intervention. Automation guarantees prompt settlements, captialisation on early payment discounts, and the nurturing of positive vendor relationships.

Step:5 Automated Reconciliation

Once payments are executed, the system initiates an automated reconciliation process and matches payment transactions with bank statements to confirm consistency in amounts and beneficiaries. Besides, the AP automation tool generates detailed reports covering all metrics like spending patterns, vendor performances, and potential cost-saving opportunities. This way, automated reconciliation simplifies the workflow, reduces errors, and empowers financial teams with data-driven insights to guide strategic decision-making.

What are the Benefits of AP Automation?

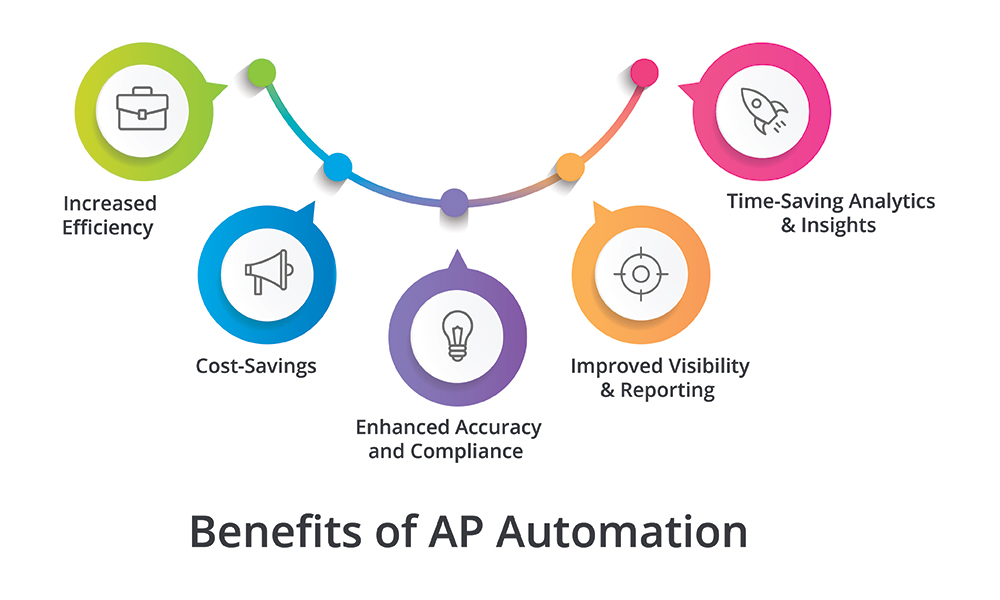

Increased Efficiency

AP automation streamlines and accelerates the entire accounts payable process, reducing the time spent on manual tasks such as data entry, invoice processing, and approval workflows. This efficiency allows organisations to allocate resources more strategically and focus on higher-value activities.

Cost-Savings

By automating routine tasks and reducing the reliance on manual labor, AP automation can lead to significant cost savings. It minimises the risk of errors associated with manual data entry and helps organisations avoid late payment fees by ensuring the timely processing of invoices. Additionally, the streamlined workflow contributes to overall operational cost reductions.

Enhanced Accuracy and Compliance

Automation reduces the likelihood of errors introduced through manual processes, ensuring greater accuracy in data entry, coding, and payment processing. This not only improves the overall quality of financial data but also enhances compliance with regulatory requirements and internal policies, reducing the risk of audits and financial discrepancies.

Improved Visibility & Reporting

AP automation software often includes robust reporting tools and dashboards, providing real-time visibility into the accounts payable process. This enhanced transparency allows organisations to track key performance indicators, monitor cash flow, and make informed decisions based on accurate and up-to-date financial data.

Time-Saving Analytics & Insights

AP automation systems generate valuable insights through analytics, helping organisations identify trends, optimise cash flow, and negotiate better terms with vendors. By leveraging data-driven insights, businesses can make informed decisions, negotiate terms with suppliers, and strategically manage their financial resources for long-term success.

What is the Right Approach to Selecting the Right AP Automation Software?

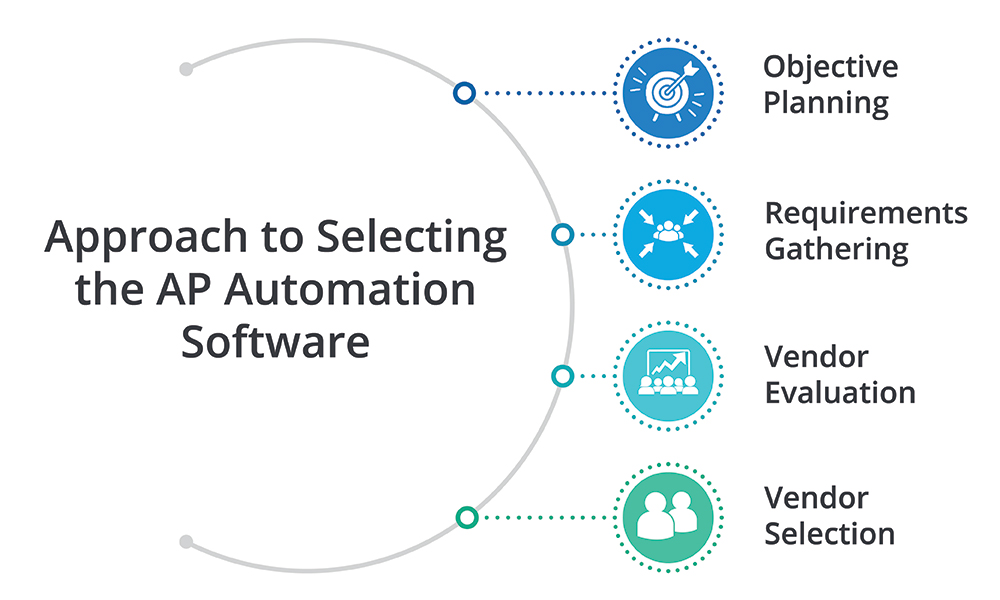

Choosing the appropriate AP automation software for your business involves the following four essential steps:

- Objective Planning: Schedule a meeting with your cross-functional team to set up your company’s goal for AP automation.

- Requirements Gathering: Task your AP department with documenting the current accounts payable processing procedures. Compile a comprehensive list of requirements for an AP automation solution. Conclude this phase by generating a request for proposal (RFP) and distributing it to eligible vendors that meet the specified criteria (refer to the checklist below in the next section).

- Vendor Evaluation: Evaluate the proposals received from vendors in response to your RFP. Scrutinize various aspects of their proposed solutions, including features, costs, and implementation approaches. Conduct a thorough assessment to determine which vendor aligns best with your organization's needs.

- Vendor Selection: Delve deeper into the evaluation of the most promising vendors, scrutinizing how well they meet your specific requirements. This may involve the development of detailed discovery documents and requesting demonstrations. Ultimately, make an informed decision and select the vendor that best suits your business needs.

A Detailed Checklist for AP Automation Requirements

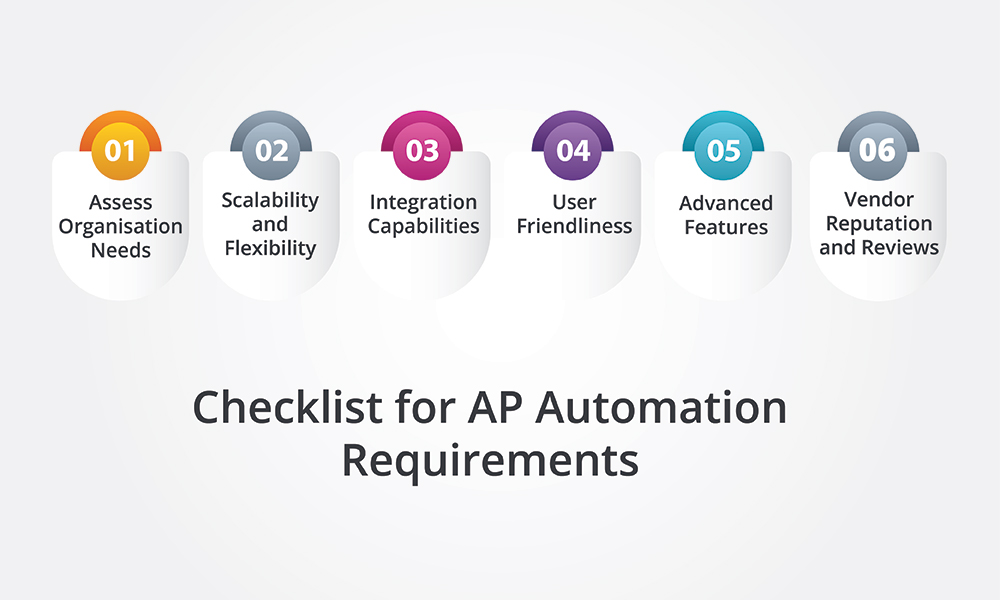

Here is a structured guide to help Australia’s SMBs identify the requirements for AP automation software that align with their specific needs:

- Assess Organisation Needs: Initiate a thorough evaluation of your organization's AP processes, transaction volume, and distinctive requirements to gain clarity on essential features for efficient operations.

- Scalability and Flexibility: Confirm that the software can adapt and scale in response to organizational growth and evolving needs. It should demonstrate flexibility to accommodate both current and future business dynamics.

- Integration Capabilities: Ensure seamless integration with existing Enterprise Resource Planning (ERP) systems, financial platforms, and other critical business tools. This guarantees a smooth flow of data, preventing information silos.

- User-Friendliness: Prioritize a user-friendly interface to facilitate efficient adoption by employees. An intuitive software design reduces the learning curve, enhancing overall productivity.

- Advanced Features: Look for advanced functionalities such as Optical Character Recognition (OCR) for invoice capture, machine learning algorithms for fraud detection, and robust reporting tools for valuable insights.

- Vendor Reputation and Reviews: Conduct thorough research on the vendor's track record, industry reputation, and customer reviews. A reputable vendor not only offers robust software but also provides continuous support and updates.

The process of choosing the right AP automation asks you to have detailed introspection into organisational needs and available solutions in response to them. By considering the above criteria, businesses can ensure they invest in a tool that delivers long-lasting value and contributes to attaining pre-defined operational excellence.

Accounts Payable Automation with Microsoft Dynamics 365 Business Central

Microsoft Dynamics 365 Business Central’s Accounts Payable Solution enables small and medium-sized businesses to save enormous amounts of time, streamline operations, and enhance productivity by automating invoice processing, and payments.

For instance, the software reduces the time and effort needed for invoice processing by eliminating manual entry and automatically computing discounts. It efficiently manages exception processing in cases of mismatches between invoices and purchase orders. Business Central also offers real-time insights into the complete accounts payable process, mitigating the risk of lost bills or fraudulent invoice payments.

Related Posts - What is Dynamics 365 Business Central?

Related Posts - Business Central Pricing and Licensing

Accounts Payable Automation FAQs

1. What Issues Does AP Automation Fix?

AP automation tackles problems in the old way of accounts payable processes. It helps businesses to get rid of slow manual data entry, lowering the chance of human mistakes that can cause financial issues. With streamlined invoice processing and approvals, AP automation ensures timely payments and maintains positive vendor relationships. These systems also improve visibility into the AP lifecycle, making financial management and decision-making easier.

2. Why does a business need AP Automation?

AP automation minimises manual tasks in accounts payable, lowering the risk of errors in invoice processing. It ensures prompt payments, improves relationships with vendors, boosts transparency in accounts payable, and supports better financial decision-making for businesses.

3. Can AP Automation deal with multiple currencies and international payments?

Yes, many advanced AP automation solutions can manage transactions in various currencies and facilitate international payments, catering to the requirements of global businesses.

Business Central Implementation

Make the most of Dynamics 365 Business Central with the help of Dynamics Square team.

Disclaimer– “All data and information provided on this blog is for informational purposes only. Dynamics Square / MPG Business Information Systems Pvt. Ltd. makes no representations as to accuracy, completeness, currentness, suitability, or validity of any information on this site and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use.”

Related Posts & Blogs

Contemporary businesses are changing at a rate of knots using innovative business solutions to stay afloat. Know more about industry trends, challenges and opportunities in detail after going through an array of exciting blogs.

Read the blogs penned by industry-experts who know the nerve of the business to start your digital transformation journey.

Dynamics 365 Business Central (formerly known as Dynamics Navision) is an all-in-one business solution. With...

Business Central is the best ERP software for small and medium businesses. It helps you manage your finances, ...

Unlock your online store’s potential with Business Central e-commerce integration....

Unlock efficient asset tracking with Dynamics 365 Business Central Asset Management. Optimise operations, redu...