Table of Content

Managing finances is a crucial aspect of running a successful small business and having the right accounting software for small businesses in Australia can make all the difference. In today’s digital age, there is a myriad of accounting software in Australia tailored specifically to the needs of small businesses. From streamlining invoicing and expense tracking to simplifying payroll and tax preparation, these tools can save time and help ensure accuracy in financial record-keeping.

In this comprehensive blog, we’ll delve into the world of accounting software and present you with the 11 best options for small businesses. Whether you are a startup entrepreneur or a seasoned business owner, finding the perfect online accounting software for small businesses can simplify your financial management tasks and provide valuable insights into your company's financial health.

We’ll explore the key features, user-friendliness, and unique benefits of each software, allowing you to make an informed decision that aligns with your business’s needs and goals. So, if you're ready to take control of your small business's finances, read on to discover the best accounting software solutions available today.

Let’s get started with the write-up.

What does Accounting Software mean for small business?

Online Accounting software for small businesses is a game-changer. It’s the financial superhero that simplifies bookkeeping, expense tracking, and invoicing, empowering business owners to allocate more time to strategic growth and less to paperwork.

Moreover, it ensures adherence to tax regulations and offers valuable financial insights. In a nutshell, accounting software is the ally every small business needs for financial control and long-term success.

Related Posts - Difference between ERP & Accounting Software

Accounting Software Usage Stats in Small Businesses

- In 2020, a substantial 78% of small companies adopted cloud accounting as their preferred accounting solution

- The cloud accounting market is anticipated to reach $4.25 million by 2023

- Only 30% of Small Businesses have accountants

- 64% of business proprietors handle their own accounting tasks

- Approximately 29% of companies have successfully integrated automated accounts payable systems, aiming to eliminate the need for manual labor and enhance precision

- 72% of self-employed contractors manage their bookkeeping and accounting tasks independently, without the assistance of professionals

11 Benefits of Accounting Software for Small Business

Accounting software can be a game-changer for small businesses in several ways. Here are some key benefits of using accounting software tailored to the needs of smaller enterprises.

Time Efficiency

Accounting software for sole traders automates many financial tasks, such as data entry, invoicing, expense tracking, and report generation. With real-time data access, businesses can make quicker decisions, while automated reporting simplifies tax compliance.

Furthermore, cloud-based solutions enable remote access and collaboration, saving time on physical record-keeping. This way, it empowers small businesses to allocate more time to strategic activities, enhancing productivity and financial management.

Accuracy

It significantly enhances accuracy levels in financial management. By automating calculations and data entry, it minimizes the risk of human errors, ensuring precise record-keeping. These platforms also facilitate real-time tracking of income & and expenses, allowing for immediate corrections if discrepancies arise.

With built-in features like automated reconciliation and financial reporting, small businesses can maintain a clear and up-to-date financial picture, reducing the likelihood of errors slipping through the cracks.

Cost Savings

Online Accounting software for small businesses provides invaluable support in achieving cost savings through various means. It automates time-consuming financial tasks, reducing the need to hire an experienced accounting professional who always asks for higher pay.

Additionally, it empowers small business owners to track all their expenses and spot the areas where they can be trimmed. This way, it enhances efficiency, reduces administrative overhead, and promotes financial discipline, all of which contributes to significant cost savings.

Improved Financial Insights

The in-built tools in accounting software in Australia provide real-time access to financial data, enabling businesses to make accurate decisions immediately. With features like expense tracking, income monitoring, and customizable financial reports, they provide a comprehensive overview of a company's financial health.

Moreover, the ability to generate forecasts and analyze historical data helps identify trends and potential areas for improvement. As a result, they can manage their finances more efficiently and make strategic choices for growth.

Tax Compliance

No business wants to deal with complicated tax procedures. That’s where online accounting software for small businesses comes in. Maintaining precise accounting records, regularly updated financial statements, and reports generated through this software simplifies the process of gathering necessary documents and information for tax filing.

Additionally, the advanced accounting software for small businesses in Australia like Dynamics 365 Finance automates tax-related processes, providing real-time data, and ensuring accuracy in tax calculations and reporting. This can save businesses time, reduce the risk of errors, and help them stay compliant with tax regulations.

Integration

It offers seamless integration capabilities, streamlining financial operations. These solutions often integrate with various software tools, such as payroll, invoicing, and inventory management systems. This integration enhances efficiency by automating data transfer and reducing manual entry, minimizing errors, and saving time.

Moreover, small businesses can easily connect their accounting software with banking institutions, facilitating effortless transaction reconciliation. Overall, these integration features simplify complex financial tasks, ensuring smoother and more accurate financial management for small enterprises.

High Data Security

There are various mechanisms in accounting software that focus mainly on enhancing data security. It typically employs encryption techniques to protect sensitive financial information during transmission and storage. Regular automated backups ensure data recovery in case of system failures or data breaches.

Furthermore, user authentication and access control restrict unauthorized personnel from accessing critical financial data. These security features collectively safeguard a small business’s financial information.

24X7 Customer Support

Top-notch accounting software distinguishes itself with exceptional customer support. Users benefit from timely assistance, resolving issues quickly and minimizing downtime. Software providers often offer various support channels, including phone, email, chat, and knowledge bases, ensuring accessibility and convenience.

Responsive support teams guide users through software features, address technical queries, and offer solutions tailored to individual needs, ultimately delivering a seamless and satisfying user experience.

Higher Scalability

Accounting software in Australia supports higher scalability by accommodating growing business needs. It can handle increased transaction volumes and complexity, adapting seamlessly as the business expands. Users can easily add new accounts, clients, or employees, without major disruptions.

Cloud-based accounting solutions offer the flexibility to scale resources up or down as required. This scalability ensures that accounting processes remain efficient and effective, regardless of the business’s size or evolving financial demands.

Audit Trail

Accounting software for sole traders maintains a robust audit trail by recording and storing all financial transactions and changes made to the system. It tracks the date, time, user, and nature of each transaction, providing a transparent and chronological record.

This audit trail enables businesses to trace the history of financial activities, ensuring accountability, compliance with regulations, and the ability to identify errors or fraudulent activities swiftly for corrective action.

Bank Reconciliation

It simplifies bank reconciliation by automating matching and reconciling transactions with bank statements. It imports bank data, allowing users to compare it with their recorded transactions effortlessly.

Any discrepancies or missing entries are flagged for review, reducing errors, and saving time. This streamlined process ensures that a business’s financial records accurately reflect the bank’s activity, minimizing reconciliation challenges and discrepancies.

How to select the best Accounting Software Solutions?

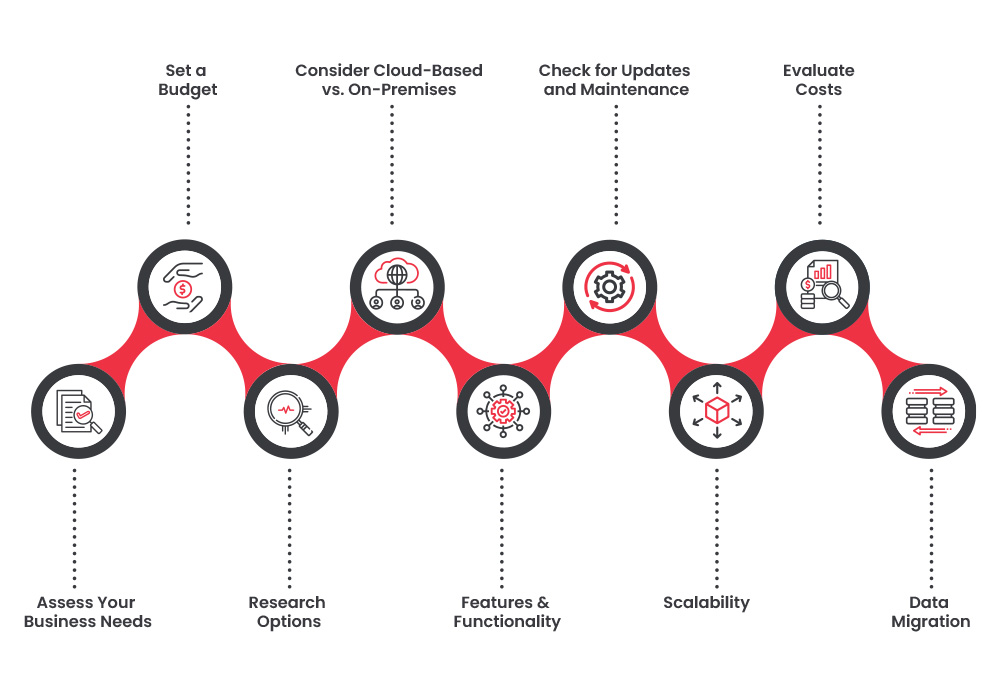

Choosing the best accounting software solution in Australia for your business is a critical decision that can greatly impact your financial management and overall operations. To make an informed choice, follow these steps.

Assess Your Business Needs

Begin by evaluating your specific accounting and financial needs. Consider factors like the size of your business, the complexity of your financial transactions, the number of users who need access, and your industry-specific requirements.

Set a Budget

Determine how much you're willing to invest in accounting software. There are options available for various budgets, so having a clear financial limit can help narrow down your choices.

Research Options

Research different accounting software solutions that align with your needs and budget. Look for well-established brands with a good reputation in your industry.

Consider Cloud-Based vs. On-Premises

Decide whether you want a cloud-based accounting system or prefer to host it on your own servers. Cloud-based solutions offer remote access and automatic updates, while on-premises solutions provide more control over data security.

Features and Functionality

Make a list of the essential features you require, such as invoicing, expense tracking, payroll management, and financial reporting. Ensure the software you choose offers these features and more if needed.

Check for Updates and Maintenance

Ensure the software vendor regularly updates and maintains the software to keep it current and secure.

Scalability

Consider whether the software can accommodate your growth. Can you add more users or features as your business expands?

Evaluate Costs

Besides the initial purchase cost, consider ongoing expenses such as subscription fees, add-ons, and potential costs for technical support or training.

Data Migration

If you're switching from another accounting system, inquire about data migration options and costs.

11 Best Accounting Software for Small Business in Australia

Choosing the right accounting software can significantly impact the financial efficiency of small businesses. Here, we've compiled a list of the 8 best accounting software solutions tailored to meet the specific needs of small enterprises.

These platforms offer a range of features, from simplified bookkeeping and invoicing to robust reporting and tax compliance tools. Whether you're a startup or an established small business, this selection will help you streamline your financial processes, and make informed decisions. Eventually, your focus will be on making more sales rather than maintaining a list of spreadsheets.

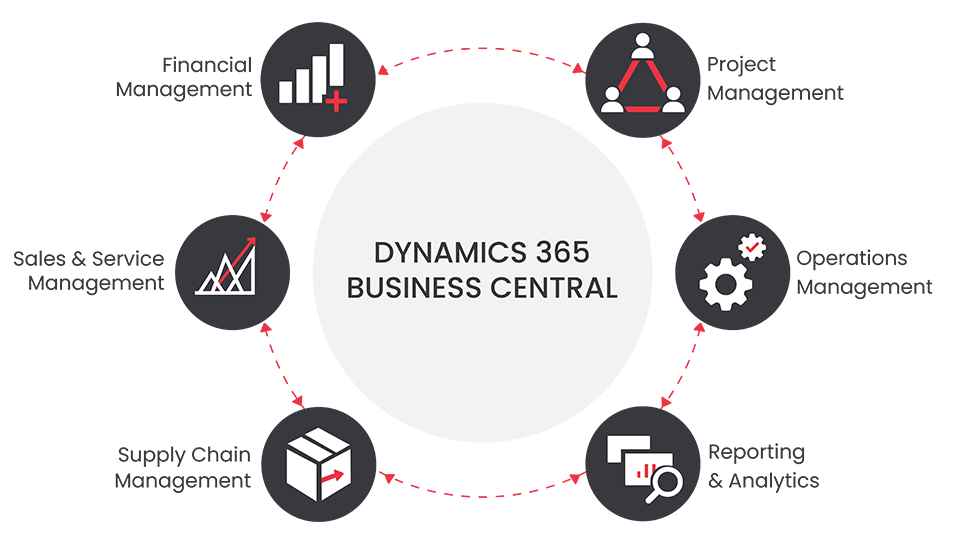

Dynamics 365 Business Central

Microsoft Dynamics 365 Business Central is an all-in-one business management solution designed for small and medium-sized enterprises (SMEs). It offers a comprehensive set of features and capabilities to manage financial operations efficiently. Here are some of the accounting features in Business Central:

- General Ledger: Business Central provides a robust general ledger system for managing and tracking financial transactions, accounts, and budgets.

- Accounts Payable: Easily manage vendor invoices, payments, and expenses, helping you maintain strong financial relationships with your supplier.

- Accounts Receivable: Streamline customer invoicing, receipts, and credit management to optimize cash flow.

- Bank Reconciliation: Automatically reconcile bank transactions, reducing the risk of errors and fraud.

- Multi-Currency Support: Handle all the transactions in multiple currencies, making it suitable for businesses with international operations.

Related Posts - Business Central for Accountants

Pros & Cons

| Pros | Cons |

| Wide range of features, including general ledger, accounts payable, accounts receivable, and more | If you haven’t worked with any Microsoft Applications before, your organization may need to provide training to the team. Otherwise, there are no cons of D365 Business Central. |

| Suitable for small and medium-sized enterprises, and it can grow with your business. | |

| Integration with other Microsoft products such as Office 365, and enhance productivity | |

| Access to real-time financial data and customizable reporting options | |

| Regular updates and improvements by Microsoft to ensure the software remains current and secure. |

Price Details

| Essentials | Premium | Team Members |

| $104.80 per user/month | $149.70 per user/month | $12 per user/month |

| Financial Management | Financial Management | Read and Approve |

| Inventory Management | Inventory Management | Run all reports |

| Sales Order Management | Sales Order Management | Employee Self Serve |

| Purchase Order Management | Purchase Order Management | |

| Project Management | Project Management | |

| X | Service Management | |

| X | Manufacturing |

Overall

As a whole, Microsoft Dynamics 365 Business Central is a powerful accounting software for small business Australia. It offers a robust set of features for financial management, scalability, integration with other Microsoft products, and valuable insights through real-time data and reporting.

However, it may have a learning curve (If you are a new user to Microsoft Products), a cloud dependency, and some limitations in terms of industry-specific features. Overall, its advantages make it a strong choice for SMEs looking for comprehensive accounting software with the backing of Microsoft's resources and support.

Related Posts - Dynamics 365 for Financial Accounting

QuickBooks Online

QuickBooks is also the best small business Australian accounting software choices designed for small businesses and individuals. It enables users to manage finances, track expenses, create invoices, and access financial data from anywhere with an internet connection.

Pros & Cons

| Pros | Cons |

| Facilitates real-time collaboration with accountants and team members | Tricky integration |

| Robust security measures protect financial data | It only allows one company per account, which means you can’t manage multiple companies altogether |

| Regularly updated with the latest features and compliance requirements | May offer fewer customization options compared to desktop software |

| Accessible from anywhere with an internet connection | Some users encounter problems with bank and credit cards while syncing |

Pricing Details

| Simple Start | Essentials | Plus |

| $25 P/M | $40 P/M | $55 P/M |

Overall

QuickBooks Online is a powerful accounting software solution that offers numerous advantages, including accessibility, collaboration, and automation. However, potential users should weigh these benefits against the disadvantages, such as cost and limited customization, to determine if it's the right fit for their business.

Careful consideration of your specific business needs and budget is crucial when deciding whether to adopt QuickBooks Online as your accounting solution.

Related Posts - Business Central vs QuickBooks

FreshBooks

FreshBooks is a popular cloud-based accounting software for sole traders tailored for small businesses and self-employed professionals. It simplifies financial tasks like invoicing, expense tracking, and time management. It has a user-friendly interface and a powerhouse of automation capabilities.

All this enables efficient financial management, making it an ideal choice for those seeking an accessible and comprehensive solution to streamline their business finances and grow their ventures.

Pros & Cons

| Pros | Cons |

| Cloud-Based | The mobile app has limitations |

| User-Friendly Interface | |

| hird-Party APP integration | |

| Affordable | |

| Advanced Invoicing Features |

Pricing Details

| Lite | Plus | Premium |

| $8.50 USD/month | $15.00 USD/month | $27.50 USD/month |

Overall

FreshBooks Online is an excellent choice for small businesses and freelancers looking for a straightforward, user-friendly accounting and invoicing solution. It excels in simplifying financial tasks and promoting efficient invoicing and expense management.

However, it may not be the best fit for larger businesses or those with complex accounting and inventory management needs. It's essential for potential users to evaluate their specific requirements and budget constraints before deciding if FreshBooks is the right software for them.

Zoho Books

Zoho Books is a cloud-based accounting software designed for small and medium-sized businesses. It offers a comprehensive suite of financial tools, including invoicing, expense tracking, bank reconciliation, and robust reporting capabilities. Zoho Books streamlines financial management, enabling users to easily handle tasks like tax compliance and payment processing.

Pros & Cons

| Pros | Cons |

| Free Trial Plan Available | Maximum of 10 Users |

| Impressive Support Options | Must invest in higher-level plans for more advanced features |

| Robust mobile app | Limited Integration |

| Feature-rich accounting software |

Pricing Details

| Free | Standard | Professional | Premium |

| ZohoBooks | $15P/M | $40 P/M | $60 P/M |

Overall

Zoho Books is a reliable accounting software solution with several advantages, including its user-friendliness, affordability, scalability, and integration capabilities. However, it does have limitations in terms of advanced features, customer support, and customization options. Businesses should carefully assess their specific requirements and budget constraints before choosing Zoho Books or any accounting software to ensure it aligns with their financial management needs.

Xero

Xero is a cloud-based accounting software designed for businesses. It streamlines financial management by offering features like invoicing, expense tracking, payroll, and customizable reporting. With multi-user access, integration capabilities, and strong security measures, it's a user-friendly choice for small to medium-sized businesses to efficiently manage their finances.

Pros & Cons

| Pros | Cons |

| Accessible from anywhere with an internet connection | Requires a monthly subscription fee, which can be added up for small businesses |

| An intuitive interface makes it easy to use, even for non-accountants | Users may need time to familiarize themselves with all features |

| Invoicing tools for creating and sending professional invoices | Advanced accounting needs may require additional software |

| Customizable financial reports provide insights into business performance | Basic inventory features may not suit all businessese |

Pricing Details

| Ultimate 10 | Premium 5 | Standard | Starter |

| $57.50 AUD per month | $42.50 AUD per month | $32.50 AUD per month | $16 AUD per month |

Overall

In evaluating Xero accounting software, it's essential to weigh up its advantages and disadvantages. On the positive side, Xero boasts a user-friendly interface, automation features, and robust integrations, simplifying financial management for businesses. However, potential downsides include subscription costs and a learning curve. Ultimately, Xero's suitability hinges on individual business needs and priorities.

Related Posts - Business Central vs Xero

Wiise

Wiise is a leading accounting software tailored for Australian businesses. It streamlines financial operations, offering features like invoicing, expense tracking, payroll, and comprehensive reporting. With localized tax compliance and cloud-based accessibility, Wiise is a smart choice for Australian enterprises looking to efficiently manage their finances.

Pros & Cons

| Pros | Cons |

| Designed to meet Australian tax and accounting standards | Primarily focused on the Australian market indicating limited global reach |

| Allow integration with various third parties | This may involve monthly fees, which can add up |

| Enable remote access and collaboration from anywhere | May not be suitable for very large and complex business |

| Offers robust reporting and analytics features for insights | Require a stable internet connection for access |

Pricing Details

| Lite | Business | Premium |

| $49/Month | $119/month | $199/month |

Overall

Wiise stands out with its tailored approach to Australian tax and accounting standards, comprehensive features, and integration capabilities. However, it may have a learning curve, involve subscription costs, and be limited in global reach. Depending on the specific needs of Australian businesses, Wiise can be a valuable tool for efficient financial management, but users should carefully evaluate how its pros and cons align with their requirements.

Oracle NetSuite

Oracle NetSuite is a leading cloud-based accounting software in Australia. It offers comprehensive financial management, from invoicing and expense tracking to reporting and payroll. With scalability, automation, and compliance features, it's a preferred choice for businesses seeking efficient accounting solutions Down Under.

Pros & Cons

| Pros | Cons |

| Scales with your business as it grows, making it suitable for various business sizes | Initial setup and customization can be expensive |

| Accessible from anywhere with an internet connection | Requires ongoing subscription fees, which may be high for some businesses |

| Highly customizable to adapt to specific business needs | Some third-party integrations may require additional configuration |

| Automates many accounting tasks, reducing manual data entry | Its extensive features can lead to a steeper learning curve |

Pricing Details

Contact Oracle support.

Overall

In assessing Oracle NetSuite, it's evident that the platform offers a robust suite of accounting tools with scalability, customization, and automation as its key strengths. However, potential drawbacks include high initial costs, a complex interface, and the need for ongoing subscription fees. The decision to adopt Oracle NetSuite should hinge on specific business requirements and budget considerations, as it caters to diverse needs but demands careful evaluation.

Odoo

Odoo is versatile business management software with an accounting module. It simplifies financial tasks, including invoicing, expense tracking, and bank reconciliation. Users can generate customizable financial reports, work with multiple currencies, and integrate with other modules and third-party applications. Odoo's user-friendly interface, automation features, and scalability make it a valuable tool for businesses of all sizes, enhancing financial management and decision-making.

Pros & Cons

| Pros | Cons |

| Cloud-based, accessible from anywhere with an internet connection | The extensive feature set can be overwhelming for small businesses or those with simple needs |

| Seamlessly integrates with third-party apps and extensions, expanding functionality | Users may require training to utilize all features effectively |

| Benefits from a large user and developer community, ensuring continuous improvement | Additional modules, support, and hosting may incur ongoing expenses |

| Scales with business growth, making it suitable for startups and enterprises alike | Mobile app features are more limited compared to the desktop version |

Pricing Details

Contact Odoo support.

Overall

Its strengths lie in customization, scalability, and a user-friendly interface. However, the complexity of features and potential costs may pose challenges for some users. Careful evaluation based on specific business needs is essential for maximizing its benefits.

MYOB

MYOB is a widely used accounting software in Australia, offering various solutions for businesses. It includes features like invoicing, expense tracking, payroll, and reporting, tailored to meet the needs of businesses of all sizes.

Pros & Cons

| Pros | Cons |

| Suitable for small to large businesses | Some users find it complex |

| Robust reporting capabilities | Software updates may disrupt workflow |

| Comprehensive inventory management | Can be expensive, particularly for advanced features |

Pricing Details

| Lite | PRO | AccountRight Plus | AccountRight Premier |

| $5/Month | $8/month | $68/month | $85/month |

Overall

MYOB has a long-standing presence in the Australian market, offering versatility and powerful features. It's a solid choice for businesses with diverse accounting needs, but it's important to consider pricing and the learning curve.

Reckon

Reckon One is an Australian accounting software designed for small businesses and sole traders. It provides features like invoicing, expense tracking, payroll, and reporting in a user-friendly platform.

Pros & Cons

| Pros | Cons |

| Affordable Pricing | May Lack advanced features |

| User-friendly for small businesses | Not ideal for larger enterprises |

| Cloud-based & and accessible from anywhere | Some users find reporting options limited |

Pricing Details

| THE BASICS | ESSENTIALS | ESSENTIALS + PAYROLL | PREMIUM |

| $6/Month | $16.50/month | $22.50/month | $31.50/month |

Overall

Reckon One is a budget-friendly choice for small Australian businesses looking for straightforward accounting software. While it may lack advanced features, its simplicity and cost-effectiveness can be appealing to certain users.

Sage

Sage Accounting is a cloud-based accounting software designed for small businesses. It offers features like invoicing, expense tracking, bank reconciliation, and financial reporting. Sage Accounting is known for its simplicity and ease of use.

Pros & Cons

| Pros | Cons |

| Simplifies reconciliation processes | Lacks advanced functionalities |

| Efficient invoicing tools | May not be suitable for growing businesses |

| Simple and easy to use | Limited support options for free users, Reporting options are basic |

Pricing Details

For Pricing visit: https://www.sage.com/en-au

Overall

Sage Accounting is a straightforward and budget-friendly option for small Australian businesses. Its user-friendly interface and affordable pricing make it a good choice for those seeking simplicity in their accounting software.

Conclusion

In conclusion, selecting the right accounting software for your small business in Australia is a pivotal decision. The above 4 options discussed in this blog offer a range of features to cater to various needs, from invoicing and expense tracking to tax compliance and financial reporting.

Henceforth, carefully assess your business requirements, budget, and scalability considerations when making your choice. Whichever software you opt for, the key is to leverage these tools to streamline your financial management, ultimately enhancing your business's efficiency and success.

FAQ's Accounting Software

1. Do small businesses use Accounting Software?

Yes, many small businesses use accounting software to manage their finances efficiently. Accounting software helps them track income and expenses, generate invoices, and maintain accurate records, saving time and reducing the risk of errors.

2. How much does cloud Accounting Software cost?

The cost of cloud accounting software varies depending on the provider and features. Prices typically start at a monthly subscription fee, ranging from $10 to $60 or more, depending on the level of functionality and the size of your business.

3. Why do small businesses need accounting software?

Small businesses need accounting software to streamline financial tasks. It ensures accurate record-keeping, facilitates tax compliance, and provides insights into financial health. This helps them make informed decisions, save time, and focus on business growth.

4. What is Cloud-based Accounting Software for small businesses?

Cloud-based accounting software for small businesses is a web-based financial management tool that stores data on remote servers. It allows users to access their financial information from anywhere, collaborate with team members, and enjoy regular software updates without the need for on-premises installations.

5. Which cloud Accounting Software for a small business is best for you?

The best cloud accounting software for your small business depends on your specific needs and budget. Popular options include Dynamics 365 Finance, QuickBooks Online, Xero, FreshBooks, and Zoho Books. Evaluate features, scalability, user-friendliness, and customer support to determine the one that aligns best with your business goals and requirements.

Searching for a Localised Business Central Implementation Partner?

Stop searching for a Business Central Implementation Partner! Our Australia-backed committed partner who understands your business is here to make your implementation seamless and efficient.

Disclaimer– “All data and information provided on this blog is for informational purposes only. Dynamics Square / MPG Business Information Systems Pvt. Ltd. makes no representations as to accuracy, completeness, currentness, suitability, or validity of any information on this site and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use.”